The planned federal budget for 2020-2021 will be Australia’s largest with a forecast deficit of $214 billion for the 2021 fiscal year.

Business summary

The key points for business are:

- The temporary full expensing deduction of capital assets until 30 June 2022 for businesses with turnover up to $5B.

- JobMaker Hiring Credit

- JobTrainer Fund

- Fringe Benefit Tax (FBT) exemption to support retraining and reskilling.

- The increase to small business entity turnover threshold

- R&D tax incentive

- Temporary loss carry-back

- Corporate residency test clarification

- Victoria’s business support grants to be Non Assessable Non Exempt income

- Manufacturing

- Environment

The key points for individual taxpayers are:

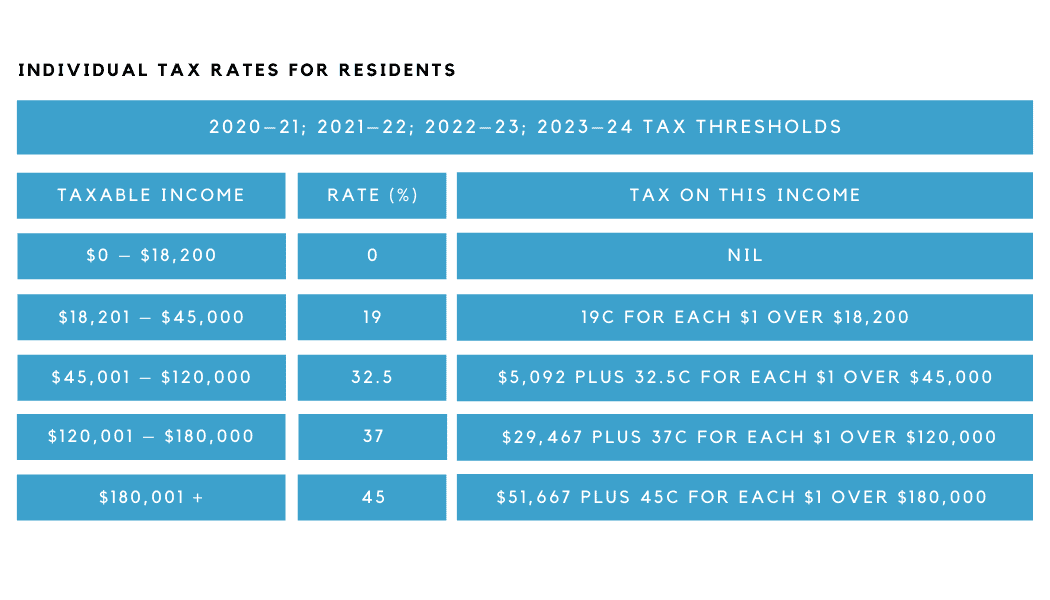

- New adjusted individual tax rates, applicable from 1 July 2020.

- Health and families

- Housing

- Super

Temporary ‘full expensing’ asset deductions

Businesses that have an aggregated turnover of less than $5B per annum will be able to deduct the full cost of assets purchased from 6 October 2020 that are first used or installed by 30 June 2022.

This deduction of the full asset cost in the year of first use applies to new depreciable assets and the cost associated with improvements made to existing eligible assets.

Businesses that have an aggregated turnover of less than $50M per annum can also apply these full cost deductions to second hand assets.

Businesses that have an aggregated turnover between $50M and $500M are able to deduct the full cost of second hand assets that cost less than $150,000, so long as they were purchased before 31 December 2020 under the current instant asset write-off. Businesses that are eligible for this deduction will have until 30 June 2021 to first use or install the assets.

Businesses that have an aggregated turnover of less than $10M are able to deduct the balance of their simplified depreciation pool at the end of the financial year while full expensing applies. The provisions that prevent small businesses from re-entering the simplified depreciation regime for five years if they opt out will continue to be suspended.

JobMaker Hiring Credit

From 7 October 2020, eligible employers will be able to claim:

- $200 a week for each additional eligible employee they hire aged 16 to 29 years old; and

- $100 a week for each additional eligible employee aged 30 to 35 years old.

The JobMaker Hiring Credit will be available up until 6 October 2021 and will be valid for up to 12 months from the date the new position is created.

The employee must be an additional job created from 7 October 2020. Year on year headcount will be compared.

To be eligible, the employee must have received the JobSeeker Payment, Youth Allowance (Other), or Parenting Payment for at least one of the previous three months at the time of hiring.

Employers are eligible to receive the JobMaker Hiring Credit if they:

- have an Australian Business Number (ABN);

- are up to date with tax lodgement obligations;

- are registered for Pay As You Go (PAYG) withholding;

- are reporting through Single Touch Payroll (STP);

- meet the additionality criteria;

- are claiming in respect of an eligible employee; and

- have kept adequate records of the paid hours worked by the employee they are claiming the hiring credit in respect of.

Note: The minimum baseline headcount is 1 so new or small businesses may also access the JobMaker Hiring Credit where they meet the criteria.

JobTrainer Fund

The Australian Government is partnering with state and territory governments to establish a new $1 billion JobTrainer Fund. The Australian Government will provide $500 million in 2020-21, contingent on matched contributions from state and territory governments.

It forms part of the $2 billion JobTrainer Skills Package which included the expansion and extension of the Supporting Apprentices and Trainees wage subsidy.

The initiative will support up to 100,000 new apprentices and trainees by paying a 50% wage subsidy, up to a cap of $7,000 per quarter, for commencing apprentices and trainees at businesses of all sizes, in all industries. This ends on 30 September 2021.

The JobTrainer Fund will provide up to 340,700 additional training places that are free or low fee, in areas of identified skills needed for job seekers and young people, including school leavers.

You can find more information on the Your Careers website and the My Skills website.

Regional recovery and tourism

In an effort to boost local tourism and jobs in regional areas, the Government will inject $250 million into regional Australia.

The package includes two measures:

- A $50 million Regional Tourism Recovery initiative to assist businesses in regions heavily reliant on international tourism such as Tropical North Queensland and Tasmania

- $200 million for an additional round of the Building Better Regions Fund. $100 million of this will be earmarked for infrastructure projects specifically linked to regional tourism.

Other regional measures include:

- $100 million over two years towards Regional Recovery Partnerships to coordinate investments with other levels of government and support recovery, diversification and growth in 10 regions across Australia such as the Snowy Mountains, Kangaroo Island, and the Hunter.

- $50.3 million towards expanding the Rural Health Multidisciplinary Training Program and investing in increased training and infrastructure for the rural health workforce. Capability on the ground will also be improved through $5.7 million in new support for Building Resilient Regional leaders.

- $317 million to the International Freight Assistance Mechanism aimed to ensure that primary producers are able to freight their high-quality perishable products into overseas markets while flights remain restricted.

- $156 million over four years will help farmers recover from the current drought and prepare for future droughts. This includes $19.6 million to extend the National Drought and North Queensland Flood Response and Recovery Agency for another year. It will also provide a further $2 billion in drought concessional loans.

- $10 million of fees will be waived by the Government in an effort to provide targeted support to the fishing and forestry industries. In addition, $25 million will be made available to haul salvaged logs to timber mills that survived the bushfires.

- $17.4 million will be provided to expand the Relocation Assistance to Take Up a Job Program, including for those who temporarily relocate to take up agriculture work.

FBT exemption to boost retraining and reskilling

The Government will provide an exemption from the Fringe Benefits Tax (FBT) for employer-provided retraining and reskilling, for employees who are redeployed to a different role in the business. The exemption will apply from the date of announcement.

Previously, FBT was payable if an employer provided training to an employee where that training was not sufficiently linked to their current role.

The exemption will not extend to retraining acquired by way of a salary packaging arrangement or training provided through Commonwealth supported places at universities, which already receive a benefit. In addition, the Government will consult on potential changes to the current arrangements for workers that undertake training at their own expense.

Reduced FBT compliance burden of record keeping

To reduce the FBT compliance burden, the Government will provide the ATO with the power to allow employers to rely on existing corporate records, rather than employee declarations and other prescribed records, to finalise their FBT returns.

Increase to small business entity turnover threshold

The small business entity turnover threshold has been expanded from $10 million to $50 million, providing many more Australian small businesses with access to the following concessions:

From 1 July 2020 newly eligible businesses can immediately deduct:

- certain start-up expenses – for example, professional expenses and legal and accounting advice

- certain prepaid expenditure where the payment covers a period of 12 months or less that ends in the next income year.

From 1 July 2021 newly eligible businesses:

- can choose to use a simplified trading stock regime, where they may choose not to account for changes in the value of trading stock for an income year, if the difference between the opening value of stock on hand and a reasonable estimate of stock on hand at the end of the year does not exceed $5,000

- will have the option to have their PAYG instalments calculated for them by us based on previously reported information

- will have two years to amend an income tax assessment for income years that start on or after 1 July 2021. The current exceptions, including for fraud or evasion, will continue to apply. Businesses can lodge an amendment application before the time limit and we may extend the time limit to give effect to the application

- will be able to apply to defer settlement of excise duty to a monthly reporting cycle, instead of the current weekly reporting cycle in respect of eligible goods

- will be able to apply to defer settlement of excise-equivalent customs duty from a weekly to monthly reporting cycle in respect to eligible goods.

In addition, from 1 July 2021 the Commissioner’s power to create a simplified accounting method determination for GST reporting purposes will be expanded to apply to businesses up to the $50 million annual aggregated turnover threshold.

From 1 April 2021 the following FBT exemptions will be extended to newly eligible businesses:

- car parking benefits provided to employees will be exempt from FBT if the parking is not provided in a commercial car park

- multiple work-related portable electronic devices provided to employees will be exempt from FBT – even if the devices have substantially identical functions.

R&D tax incentives

The R&D tax incentive provides a tax offset for eligible R&D activities in an effort to encourage companies to invest in R&D that benefits Australia. It has two main components:

- a refundable tax offset for certain eligible entities whose aggregated turnover is less than $20 million

- a non-refundable tax offset for all other eligible entities.

For small companies with an aggregated annual turnover of less than $20 million:

- The refundable R&D tax offset is being set at 18.5 percentage points above the claimant’s company tax rate, and

- the $4 million cap on annual cash refunds will not proceed.

For larger entities:

- The number of intensity tiers will be reduced from three to two. This will provide greater certainty for R&D investment while still rewarding those companies that commit a greater proportion of their business expenditure to R&D.

- The R&D premium ties the rates of the non-refundable R&D tax offset to a company’s incremental R&D intensity, which is R&D expenditure as a proportion of total expenses for the year.

- The marginal R&D premium will be the claimant’s company tax rate plus:

- 8.5% above the claimant’s company tax rate for R&D expenditure between 0% and 2% R&D intensity for larger companies.

- 16.5% above the claimant’s company tax rate for R&D expenditure above 2% R&D intensity for larger companies.

All changes to the program will apply to income years starting on or after 1 July 2021.

Temporary loss carry-back

Companies with a turnover of up to $5 billion will be able to offset tax losses against previous profits on which tax has been paid. Losses incurred until to June 2022 can be offset against prior profits made in or after the 2018-19 financial year.

The amount carried back cannot be more than the earlier taxed profits and the carry-back will not be able to generate a franking account deficit.

The tax refund will be available on an election basis by eligible businesses when they lodge their 2020-21 and 2021-22 tax returns. Companies that do not elect to carry back losses under this measure can still carry losses forward as normal.

Corporate residency test to be clarified

Under the proposed amendment, a company incorporated offshore will be treated as an Australian tax resident if it has a significant economic connection to Australia.

This test will have two components:

- one, where the company’s core commercial activities are undertaken in Australia; and

- two, where its central management and control is in Australia.

Victoria’s business support grants to be NANE

The Victoria Business Support grants given to small and medium sized businesses will be treated as non-assessable, non-exempt (NANE) income for tax purposes by the Federal Government.

The tax exemption will be time-limited for grants paid until 30 June 2021.

Manufacturing

The Government has set aside $1.3billion as part of The Modern Manufacturing Strategy which it will co-invest with leading manufacturers in order to help them achieve scale, commercialise world-leading research and connect to international markets.

A further $107 million will be directed towards the Supply Chain Resilience Initiative to identify

and address supply chain vulnerabilities.

$52.8 million will be made available to small and medium manufacturers in a second round of the Manufacturing Modernisation Fund. This will help manufacturers scale- up, invest in new technologies, create and maintain jobs and upskill their workers.

A further $50 million is being provided to Industry Growth Centres to deliver immediate support to manufacturing priority industries.

INDIVIDUAL TAXPAYERS

The Government is delivering an additional $17.8 billion in personal income tax relief to support the economic recovery, including an additional $12.5 billion over the next 12 months.

Health and families

The Government has invested $3.2 billion in personal protective equipment (PPE) and it is also providing $112 million for the continuation of Medicare-rebated telehealth services for GP, allied health and specialist consultations to ensure ongoing access to essential health services.

It is providing an additional $746.3 million to support senior Australians in aged care, workers and providers to respond to the COVID-19 pandemic. This includes $245 million for a COVID-19 Support Payment to assist providers with additional costs and $205.1 million for the Workforce Retention Bonus Payment for frontline aged care workers.

Further support for older Australians who wish to stay at home for longer will be provided through $1.6 billion for an additional 23,000 home care packages across all package levels.

Additional funding will provide access to an extra 10 Medicare-subsidised psychological therapy sessions for people with a mental health care plan.

Funding for the National Disability Insurance Scheme (NDIS) has been guaranteed, as the Government is providing a further $3.9 billion to the NDIS.

Funding of $102 million over four years from 2020-21 for veteran mental health and well-being initiatives includes:

- $94.3 million to improve mental health outcomes and ensure high-quality care for our older veterans and their families by increasing fees paid to mental health, social work and community nursing providers

- $7.4 million to expand Open Arms counselling services and the Coordinated Veterans’ Care program.

The Government will invest $453 million to extend the National Partnership Agreement on Universal Access to Early Childhood Education until the end of 2021. In 2020-21, it will pay approximately $9 billion in the means-tested Child Care Subsidy payments.

Superannuation

For the first time, you will keep your super fund when you change jobs, stopping the creation of unintended multiple super accounts and the erosion of your super balance. A new super account will no longer be created automatically every time you start a new job.

Instead, your super will be ‘stapled’ to you, so that you keep your current super fund when you change jobs. Your employer will pay your super to your existing superannuation fund if you have one, unless you select another fund.

By 1 July 2021:

- If an employee does not nominate an account at the time they start a new job, employers will pay their superannuation contributions to their existing fund.

- Employers will obtain information about the employee’s existing superannuation fund from the ATO.

- The employer will do this by logging onto ATO online services and entering the employee’s details. Once an account has been selected, the employer will pay superannuation contributions into the employee’s account.

- If an employee does not have an existing superannuation account and does not make a decision regarding a fund, the employer will pay the employee’s superannuation into their nominated default superannuation fund.

A new, interactive, online YourSuper comparison tool will help you decide which super product best meets your needs.

By 1 July 2021, the YourSuper tool will:

- Provide a table of simple super products (MySuper) ranked by fees and investment returns.

- Link you to super fund websites where you can choose a MySuper product.

- Show your current super accounts and prompt you to consider consolidating accounts if you have more than one.

This tool will make it easier for you to compare the fees and performance of super funds in the market, creating more competition and making super funds work harder to manage your money.

Housing

An additional 10,000 first home buyers will be able to purchase a new home sooner under the extension to the First Home Loan Deposit Scheme. The additional 10,000 places will be provided in 2020-21.

This will allow first home buyers to secure a loan to build a new home or purchase a newly built dwelling with a deposit of as little as 5%, with the Government guaranteeing up to 15% of a loan.

The Government will increase its guarantee of the National Housing Finance and Investment Corporation (NHFIC) by $1 billion, enabling NHFIC to increase its bond issuance into the wholesale capital market.

Exempting granny flat arrangements from CGT

A targeted capital gains tax (CGT) exemption for granny flat arrangements will be provided where there is a formal written agreement. The exemption will apply to arrangements with older Australians or those with a disability.

This measure arises from concerns that the current CGT rules impede the creation of formal and legally enforceable granny flat arrangements. It’s aimed at removing these CGT impediments and reducing the risk of abuse to vulnerable older Australians. However, the proposed measures will only apply to agreements that are entered into because of family relationships or other personal ties, and will not apply to commercial rental arrangements.