ATO’s view on Work-Related Expenses and deductions being claimed

Work-Related Expenses and what to do about them

There have been numerous media reports of late about the ATO’s view on work-related deductions being claimed by individual taxpayers. This is on the back of work-related expense claims in 2017 reaching a record $21.2 billion. Reports suggest the ATO are alarmed about over-claiming and downright fraud.

Tax & Super Australia have indicated that the ATO’s advice to tax professionals before including claims for work-related expenses in the upcoming 2018 returns, is to ensure their clients can show:

- The expense was paid personally and not reimbursed

- The expense was incurred in earning their income

- The have correct documentation to substantiate their claim

The crackdown on work-related expenses comes after the release of a Parliamentary report on the inquiry into tax deductibility.

Why the inquiry?

The inquiry was prompted after the ATO identified $100 million in incorrect claims made for work-related expenses in a single year, comprising approximately one in 1,000 taxpayers.

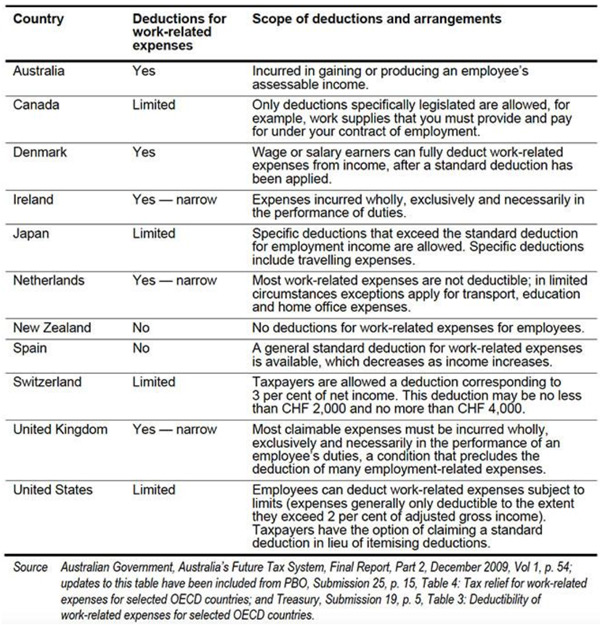

In comparison to many other countries, the report found that the Australian tax system is quite generous in allowing work-related expenses as tax deductions. To demonstrate the comparison, the report looked at the treatment of work-related expenses in other jurisdictions.

International comparison of deductions for WREs

Finding the connection

An interesting fact identified in the inquiry was that most work-related expense claims increased with income. While this may seem strange at first glance, in that expenses should not necessarily increase if a taxpayer enjoys an increase in salary increase, it can be an accepted factor that may not be so obvious.

To use motor vehicles as an example, if a taxpayer has a higher salary it’s a natural tendency for them to buy a more expensive car. With that, there is an expectation that the running costs and other expenses may be higher also.

Where to next?

A further issue identified in the review was the significant variation in work-related claims made by taxpayers with identical occupations and incomes. In part, this issue came down to individuals interpreting their expenses differently to others, while in some cases employers elect to pay for expenses that others do not.

The paper went on to note that in Canada, where their tax system is similar to Australia, it is estimated that approximately 10% to 15% of work-related expense claims are invalid. If there was a similar amount of invalid claims in Australia, the government concluded that this could amount to an over claim in deductions of between $1 and $2 billion.

In conclusion, the review made the following three findings in relation to work-related expenses:

- The scope of work-related expenses for which a tax deduction can be claimed is broad by international standards.

- Deductibility for work-related expenses adds a great deal of complexity to the personal income tax system and imposes high compliance costs on taxpayers.

- The scope and number of claims significantly limits opportunities for fully automating the preparation of tax returns using pre-filling.

In other words, watch this space.

At Teamwork Accounting we can help you review your Work-Related Expenses.